I made my first investment at age eleven. I was wasting my life until then.

Warren Buffet

(A learned investor, business tycoon, philanthropist, and the chairman and CEO of Berkshire Hathaway with a net worth of 85.90 Billion US$ as on 2020)

Financial planning at an early stage

The sooner you start the bigger corpus you can accumulate over the years

Builds savings habit

A penny saved from an early age cultivates the habit of ‘saving before spending’. Such a habit can help in keeping splurging, impulse purchases and financial worries at bay.

Streamlines finances

A systematic investment of small amount on periodic basis helps you prioritise your primary expenses and organise money matters in the future.

Averages out risk

Early investment also means longer investment period which offers relatively more time to average out ups and downs in the investment and therefore helps mitigate the risk.

Starting at a young age improves one’s risk-taking ability

Such ability is helpful to keep calm during the wealth creation journey through equity or any other volatile asset class.

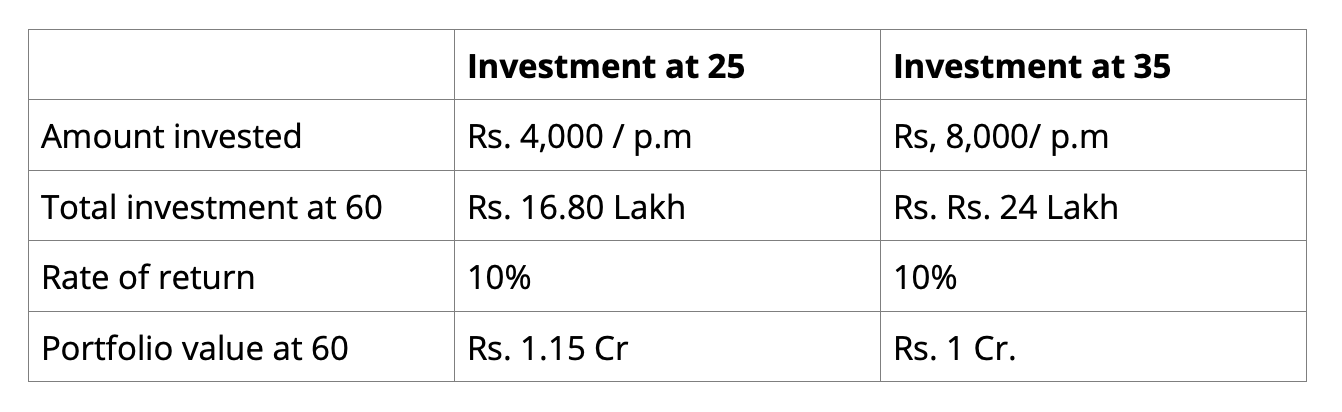

Early investment means compounding benefits

With the right investment product and time on side, one can build considerable corpus by earning interest on interest.

Saviour during emergency

An early investor has a contingency fund handy and is ready to get through financial crisis without having to borrow money from someone else

An early start is a step closer to financial freedom

Financial planning at an early age cultivates investment discipline within you which can gradually lead towards financial freedom.

Consult A Professional To Know More

Scope of Financial Planning services

1. Personal financial analysis

2. Debt counselling

3. Insurance planning

4. Investment planning/ Goal based planning/ Asset allocation

5. Tax planning

6 .Estate planning